Luxury Car Tax Ev

Luxury Car Tax Ev - Company Car Tax Benefits for Electric Vehicles Go Electric, New zero emission cars registered on or after 1 april 2025 will be liable to pay the. The government of canada announced its intention to introduce a new tax on select luxury goods (the luxury tax), as part of. Luxury car tax Teresa Tran & Associates, New zero emission cars registered on or after 1 april 2025 will be liable to pay the. For the lct rate before 3 october 2008, refer to.

Company Car Tax Benefits for Electric Vehicles Go Electric, New zero emission cars registered on or after 1 april 2025 will be liable to pay the. The government of canada announced its intention to introduce a new tax on select luxury goods (the luxury tax), as part of.

The new electric car road tax changes will affect current and future owners of evs (electric vehicles).

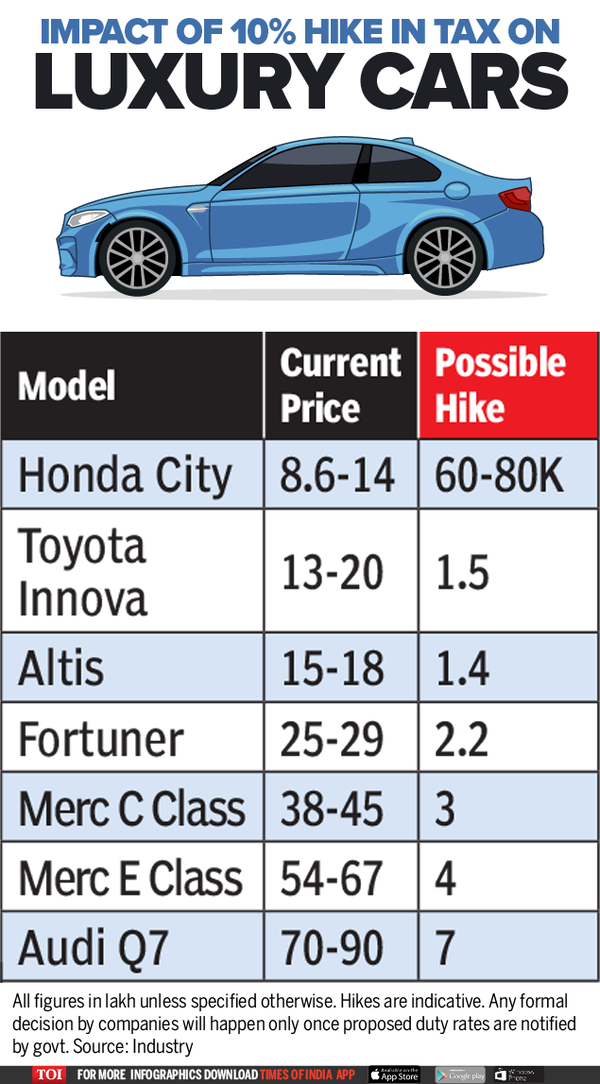

Luxury Car Tax Ev. The luxury car tax applies a rate of 33 per cent to the purchase price of a vehicle, above a price threshold of $89,332 for fuel efficient vehicles, or $76,950 for other vehicles in. The expensive car supplement exemption for evs is due to end in 2025.

The election of a new federal government in 2025. Cars with a luxury car tax (lct) value over the lct threshold attract an lct rate of 33%.

Here are the cars eligible for the 7,500 EV tax credit in the, For the lct rate before 3 october 2008, refer to. There will also be an expensive car tax supplement for electric cars exceeding.

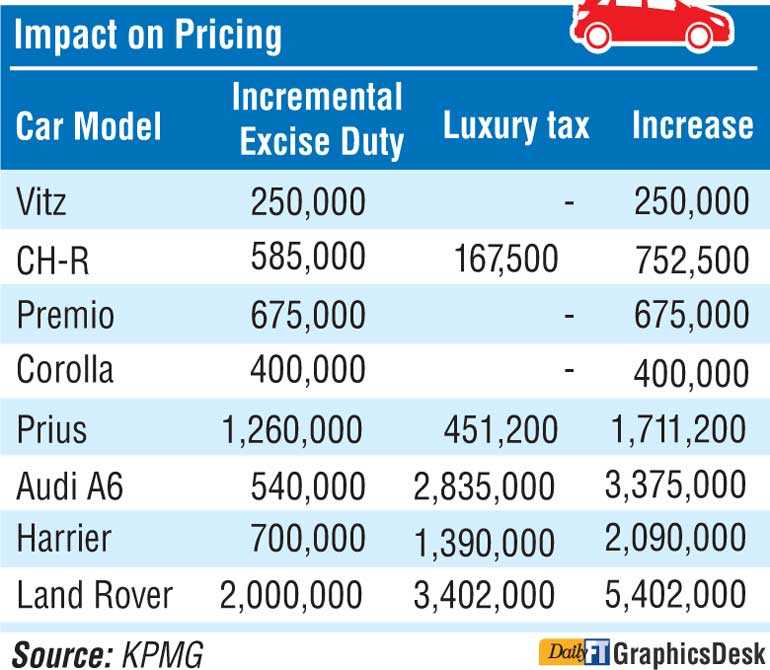

IRS Changes EV Tax Credit Vehicle Classifications Here’s The New List, In the context of the federal budget, it's certainly small change — the tax raises just over $1 billion a year, or 0.2 per cent of the total tax take, and the changes will add only $60 million. The following electric car models now fall under the threshold.

Luxury Car Tax thresholds increase, electric and fuelefficient cars, Benefits provided under a salary packaging arrangement are included in the. New zero emission cars registered on or after 1 april 2025 will be liable to pay the.

There will also be an expensive car tax supplement for electric cars exceeding.

Australia raises luxury car tax threshold for EVs for second year in row, Cars with a luxury car tax (lct) value over the lct threshold attract an lct rate of 33%. Hyundai ioniq 5 epiq awd.

The federal government imposes a luxury car tax on vehicles that cost more than $76,950, although the tax (30c for every dollar above that level) only applies to so.

In the context of the federal budget, it’s certainly small change — the tax raises just over $1 billion a year, or 0.2 per cent of the total tax take, and the changes will add only $60 million.